In hotel accounting, several key financial statements are used to assess financial health, maintain transparency, and help in decision-making. Hotel accounting involves applying accounting principles and industry standards to manage revenue, track expenses, and comply with tax and financial regulations. With these financial responsibilities in mind, the right accounting software can make the entire process more efficient.

Get business insights and tips

Additionally, you should be able to think critically and organizedly, so you can manage your time effectively. It is always better to manage everything in one place, mainly if hotel owners focus on improving ROI. The https://www.bookstime.com/ all-in-one hotel accounting solution integrates tools, data, and related processes to bypass jumps between different systems and integrate all operations on a single platform.

- The total money made comes from conference spaces, food and beverage sales, hotel rates, and other ancillary services.

- This could be everything from your suppliers’ bank details to your own business bank accounts, tax information or outstanding loans.

- While doing his MBA, Manit joined Zomato in Dubai as a sales manager and worked with them for almost 7 years.

- By analyzing dining patterns and customer preferences, restaurants can design menus that maximize profit margins and encourage higher spending.

- This makes it easy to set up employee profiles and input their salary and benefits so they always receive what they’re entitled to.

Streamline Accounting Processes:

By following these basic hotel and restaurant accounting tips, it’s easy to take the reins and manage your accounting in-house with the help of your management team. Plus, with the help of your POS and an accounting system, you can ensure that your business’s financial records are accurate and up-to-date. This will empower you to make informed decisions about your business and ultimately drive growth and profitability. Hotels should also track occupancy rates and average daily rate (ADR) to get insights into revenue trends. This helps in understanding the hotel’s financial performance and forecasting future revenue. They manage accounting and finance teams, create and enforce financial policies, and maintain compliance with relevant tax laws and regulations.

North Star Lodging Management

This ensures each department is charged fairly for the shared costs it incurs, providing a more accurate reflection of each department’s profitability. A Chart of Accounts (COA) is a structured list of all the accounts used to record your daily transactions. These operations form the foundation of your financial statements, ensuring that every dollar in and out is properly tracked and categorized.

- Whether you are a hotel owner, operator, or financial controller, understanding and implementing USALI is crucial for driving performance and achieving financial clarity in the dynamic world of hospitality.

- With tight profit margins and complex operations, precise financial management is essential for sustainability.

- Free, quick & easy to setup, automated & integrated hassle-free solution with 80+ specialized industry standard reporting.

- These tools are designed to simplify complex tasks and help hotels manage their accounts with minimal effort.

- With automated staff management, precise payroll synchronization with Xero, detailed reporting and analytics, and simplified tax compliance, this software ensures operational excellence.

Inova Insights: Streamlining Payroll & HR for Hospitality

For Bookkeeping for Startups instance, if a guest checks into a hotel and books a room, the hotel records the revenue immediately, even if the guest will pay at checkout. Similarly, if the hotel incurs an expense, such as a vendor providing services, the cost is recorded when it happens, regardless of when payment is made. The most optimal price of a hotel room will fluctuate depending on the season, day of the week, and ongoing events in the area.

Room rates can go up or down depending on the time of year, how full the hotel is, and if there are any special hotel accounting events happening, just like how airlines adjust their prices. Hotel accounting follows general accounting principles but is customized for hotels. Accounting is the organized process of recording and managing a business’s financial transactions.

- Effective budgeting ensures that all departments within the organization have the necessary funds to operate smoothly while maintaining profitability.

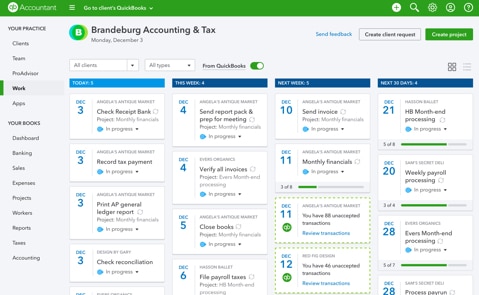

- Modern hotels rely on sophisticated software that integrates property management, point-of-sale, and accounting to provide real-time financial data and automate transactions.

- As previously mentioned, some hotels have more than one operating system because they’re not using an OS that can do it all.

- M3’s Outsourced Accounting services are designed to alleviate this burden, offering you a team of seasoned hospitality accounting professionals who understand the unique challenges of the industry.

When should a hotel hire a professional hospitality accountant?

Accountants record financial information, such as financial reports, tax returns, budgets, and financial transactions. They are also responsible for ensuring that the company’s finances are in order and that all necessary business processes are followed. A seasoned Chartered Accountant with 15+ years of experience in accounting and finance within the hospitality industry. At Paperchase, I specialized in client success management, process optimization, budgeting and forecasting, implementation, weekly analytics, and client onboarding. Committed to leveraging technology to improve operational efficiency, build lasting client relationships, and align business strategies with stakeholder objectives. Recognized for a robust technical skillset and exceptional interpersonal communication across all organizational levels.