CPA Follow Advisor is the definitive expertise and practice management resource for accounting and tax professionals. CPA Apply Advisor has products that deliver highly effective content to you in a wide range of forms including on-line, e-mail and social media. She started her profession as accountant and later made the swap to writing full time, concentrating on business and expertise, with a give attention to small business. A former QuickBooks beta tester, Mary has been a featured regular contributor to CPA Practice Advisor since 2002, and he or she has also been printed in The Motley Fool, The Blueprint, and Property Supervisor.com. She presently writes a monthly accounting and technology-related weblog for PLANERGY, and ghostwrites several blogs for varied software program firms.

Options include an easy three-step payroll course of, free setup, and limitless payrolls. Customers can make on-the-fly pay fee changes and have entry to a free worker portal. The software program also offers free direct deposit, the power to track reported tips, and customizable hours, money varieties, and deductions. Options embody custom settings and calculations for taxes, pensions, and go away. The worker self-service portal, Xero Me, also allows employees to access payslips and manage depart requests, subsequently decreasing the administrative burden on accountants.

Embedded Compliance And Real-time Tax Updates

- It additionally offers detailed employee self-service portals, enabling employees to entry pay stubs and tax paperwork independently, which helps streamline communication and reduce queries to HR.

- Manual entries are invitations to errors, and mistakes can cost money.

- The software program provides e-payment and e-filing capabilities which lets you pace the whole process even if the submit ion tax payments and tax forms are carried out by yourself.

- We used this technique lately with a client on an older version of QuickBooks so when we obtained the file we transformed it to model 2005 and entered the key code to do our work.

- Nevertheless, the range of integrations Justworks offers can’t match these obtainable with Rippling, ADP and different payroll distributors.

He has additionally worked with Sage, FreshBooks, and many different software platforms. Edward’s ardour for clarity, accuracy, and innovation is clear in his writing. He is nicely versed in the way to simplify complicated technical ideas and turn them into easy-to-understand content material for our readers.

This means staff get their paychecks straight into their financial institution accounts—it’s fast and hassle-free. Toss out guide checks and the tedious journeys to the financial institution as a end result of direct deposit takes care of that. Simple to run options for retail and e-commerce businesses, optimizing stock management, order success, and customer expertise, driving effectivity and profitability. @SashaMC I could additionally be misunderstanding this, but it actually sounds such as you’re suggesting that the way to resolve that is to only cancel the old accountant’s Quickbooks payroll subscription totally. Since I truly have Quickbooks desktop I even have three completely different firms that entry the same payroll subscription.

Options embrace professional hiring & HR support and a mobile app that enables customers to manage payroll and employee data from anywhere, offering flexibility and comfort with 24/7 assistance from payroll specialists. It also offers direct deposit, an employee self-service portal, compliance help, time and attendance monitoring, and garnishment cost providers. The Full-service option is a suitable choice for businesses that plan to process their payroll however want that their taxes and payroll tax returns get filed for them. Intuit® will e-file and e-pay federal, state taxes, quarterly and annual payroll tax returns, including year-end processing of W-2s. It ought to be saved in mind that your shoppers should set this up themselves.

This integration permits accountants and HR professionals to handle all employee management processes from one platform. Xero is a cloud-based accounting software program tailored for small to medium-sized businesses, providing a extensive range of options to handle monetary tasks effectively. Its intuitive interface and real-time financial insights assist business owners keep control over their funds. RUN powered by ADP is a complete payroll and HR resolution designed specifically for small companies. It simplifies payroll processing, tax submitting, and employee payment choices.

Am I In A Position To Automate Year-end Tax Varieties And Filings With Payroll Software?

The problem of printing or emailing checks is eliminated with the Direct Deposit feature supplied by QuickBooks Enhanced Payroll for accountants. The hassle of printing or emailing checks is eliminated with the QuickBooks Direct Deposit feature provided by QuickBooks Enhanced Payroll for accountants. Search results can be filtered by as many as two choices, together with regulatory surroundings, expertise focus and go away time necessities. Most mortgages don’t come with a prepayment penalty, so you can even make extra payments or repay the loan in full at any time without incurring a payment. Furthermore, it is essential to maintain accurate and up-to-date employee records. To ensure this, you probably can edit their information in case of changes corresponding to a reputation change, up to date checking account particulars, alterations to W-4 submitting information, or when the employee moves to a place.

Let’s face it—taxes are nobody’s favorite topic, however they’re unavoidable! The good news is Enhanced Payroll helps take the sting out of tax season by guaranteeing you are compliant all year round. From calculating payroll taxes to filing them, the tool covers all bases. From here, you’ll be able to manage everything from hourly wages to salary entries effortlessly. The dashboard provides you fast access to particular person and collective payroll data without the usual rigmarole.

Just like setting the table earlier than a giant meal, preparation makes every little thing that follows more pleasant and stress-free. It’ll ask for your corporation information, like EIN and tax details, so hold these helpful. Whether you might have a roster of three or thirty, inputting their details is easy.

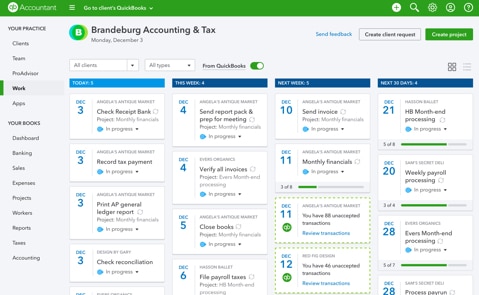

Accountants profit from unified dashboards the place general ledger entries, employee advantages, and payroll data are synchronized, lowering reconciliation time and errors. Specifically is a complete HR and payroll software particularly designed for mid-sized corporations. It focuses on simplifying advanced HR processes while https://www.intuit-payroll.org/ offering tools for payroll, benefits, and compliance within one built-in platform. Patriot Payroll is a payroll processing software program designed to be both inexpensive and simple to use.

Leave a Reply